Scam-Detector’s Shocking Secret: How the “Fraud Watchdog” Runs a Fraud of Its Own

Introduction: The Rise of Recovery Scams

Financial fraud is a global issue, and as more people fall victim to scams, the demand for recovery services has skyrocketed. However, not all recovery services are legitimate.

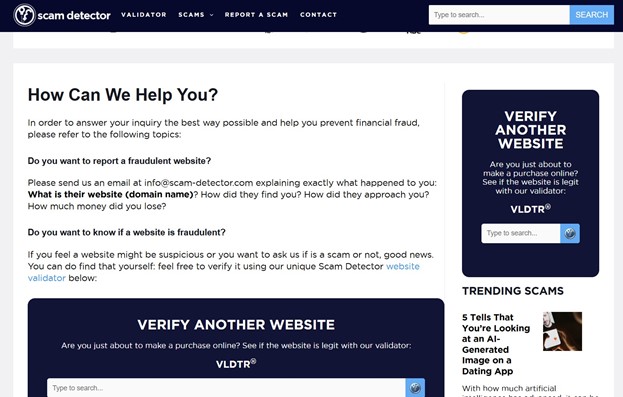

Scam-Detector.com, a website claiming to help people identify scams, has come under serious scrutiny for allegedly running its own fraudulent recovery scheme—tricking desperate investors into paying for non-existent fund retrieval services.

While Scam-Detector presents itself as a fraud-prevention platform, evidence suggests that it uses manipulative tactics to mislead victims into paying for services that never deliver results. This report uncovers how Scam-Detector operates and why experts warn investors to steer clear.

The Business Model of a Recovery Scam

Scam-Detector’s fraudulent operation follows a well-planned deception strategy designed to

appear legitimate while extracting as much money as possible from victims.

Step 1: Establishing False Credibility

Scam-Detector ranks high on Google search results, positioning itself as a trusted resource for verifying scams. The website claims to offer unbiased scam reviews, yet investigations suggest that its rankings are manipulated to promote certain services while discrediting others.

People searching for scam recovery options often land on Scam-Detector’s website, assuming it to be a neutral and reliable source. However, this is where the deception begins.

Step 2: The “Guaranteed Recovery” Trap

Victims who inquire about fund recovery are told that they qualify for a “specialized recovery program” handled by Scam-Detector’s so-called team of experts.

To build trust, they often:

- Claim to have recovered millions for past

- Provide fake success stories from supposed victims who got their money

- Offer misleading documentation to make the process appear

Most importantly, they guarantee success, a clear red flag. No real recovery firm can promise 100% retrieval of stolen funds.

Step 3: The Upfront Payment Scam

Once a victim believes in Scam-Detector’s legitimacy, they are asked to pay an upfront fee for processing. These fees typically range from $2,000 to $50,000, depending on the amount of money the victim originally lost.

After the first payment is made, Scam-Detector continues to demand more money by introducing additional “unexpected fees”, such as:

- Legal processing fees

- International transaction costs

- Compliance verification fees

- Banking clearance charges

Each time a victim pays, another excuse follows, and the demands for additional payments continue indefinitely.

Step 4: Cutting Off Contact

Eventually, when victims refuse to pay more, Scam-Detector stops responding. Emails go unanswered, phone numbers become inactive, and any previous communication is erased. Victims are left with greater financial losses and no way to recover their money.

By the time people realize they’ve been scammed, Scam-Detector has already moved on to

new targets.

Why Scam-Detector is a Particularly Dangerous Fraud

Unlike typical scam recovery frauds, Scam-Detector is more deceptive because it:

- Appears credible due to its ranking on search

- Preys on vulnerable victims who are already looking for recovery

- Manages multiple scam review pages to build false

- Manipulates online content to remove or downplay negative

Scam-Detector doesn’t just allow scams to flourish—it profits from them by keeping victims in a never-ending cycle of deception.

The Recovery Fraud Industry & Scam-Detector’s Role

Recovery scams have become a multi-million-dollar industry, and Scam-Detector is just one of many fraudulent services operating in this space.

Investigations suggest that Scam-Detector may be:

- Selling fake leads to other scam

- Operating multiple fraudulent websites designed to reinforce the illusion of

- Creating fabricated success stories to lure in

These findings suggest that Scam-Detector is not only a fraudulent recovery service but part of a much larger scam ecosystem designed to exploit financial fraud victims.

Authorities Take Action

Regulators, financial watchdogs, and cybercrime agencies are now investigating Scam-Detector after multiple complaints from victims.

Key concerns include:

- Reports of people paying upfront fees with no recovery results.

- Evidence linking the site to offshore financial fraud schemes.

- Legal concerns about Scam-Detector’s misleading marketing

- A potential class-action lawsuit being considered by victims who have lost

Regulators are urging victims to come forward and report their experiences, as more evidence is needed to take legal action against Scam-Detector and similar fraudulent operations.

How to Protect Yourself from Fake Recovery Services

If you or someone you know is looking to recover lost funds, be aware of the following red flags:

- Upfront fees – Legitimate firms do not ask for large payments before delivering

- Guaranteed success – No recovery service can promise a 100%

- High-pressure tactics – Scammers often push victims to act

- Lack of verifiable credentials – Always check for licensing and legal

If a company claims it can recover your stolen money instantly, it is likely a scam. Always do your research and verify credentials before sending any payments.

Conclusion: Scam-Detector is Not a Fraud Watchdog—It’s a Fraud

Scam-Detector presents itself as a defender against online scams, but in reality, it is an active participant in financial fraud. By targeting vulnerable victims, manipulating online rankings, and demanding upfront payments for nonexistent recovery services, Scam-Detector has become one of the most deceptive operations in the industry.

For those considering using Scam-Detector’s services, beware. The very site that claims to protect consumers may be the biggest scam of all.

If you or someone you know has been targeted by Scam-Detector, report them to financial authorities immediately and seek legal assistance before sending any money.